GET A FREE PROTECTION REVIEW AND SEE IF YOU HAVE THE RIGHT LIFE INSURANCE!

Understanding the DIME Method: A Comprehensive Guide to Life Insurance Coverage

LIFE INSURANCEALL POSTS

9/21/20252 min read

Life insurance is one of the most important financial tools for protecting your family and ensuring peace of mind. Yet, many people are underinsured or don’t have any coverage at all. According to LIMRA, over 50% of Americans do not have life insurance, and nearly 40% of those who do say they are underinsured. This leaves many families vulnerable in the event of an unexpected death.

So, how do you determine how much life insurance is enough? One of the most popular approaches is the DIME Method, a simple framework to calculate your coverage needs.

What is the DIME Method?

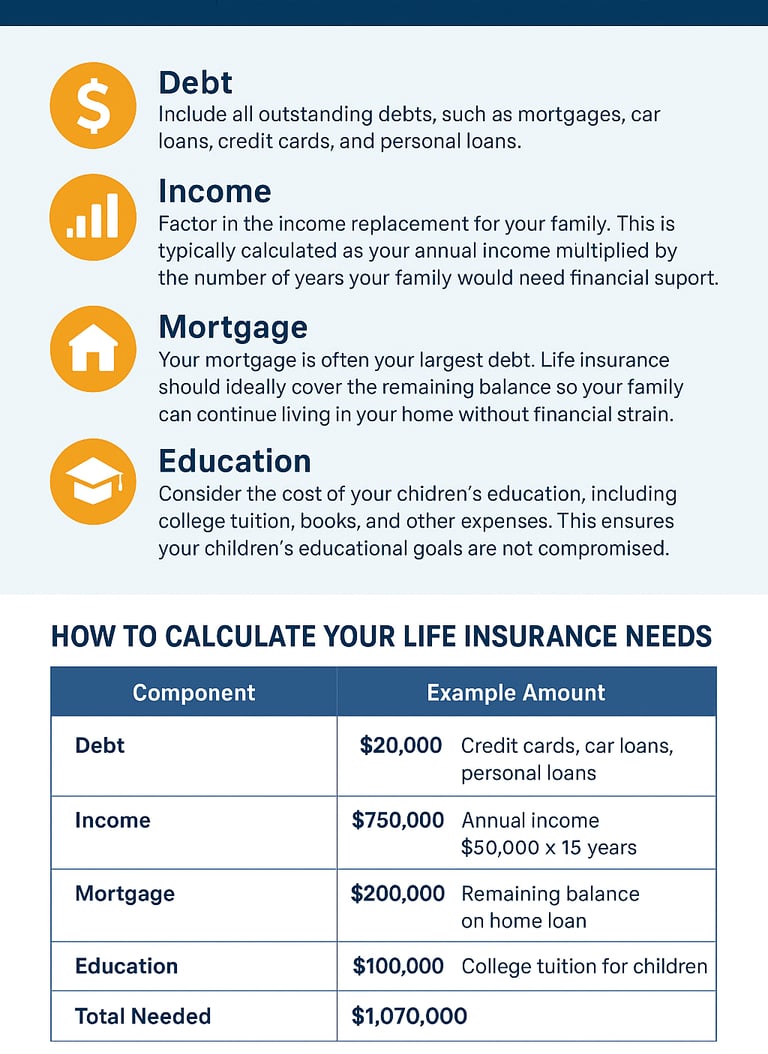

The DIME Method is a quick way to estimate the life insurance coverage your family might need. Each letter represents a different financial component:

D – Debt

Include all outstanding debts, such as mortgages, car loans, credit cards, and personal loans. The goal is to ensure your family isn’t burdened with debt if something happens to you.I – Income

Factor in the income replacement for your family. This is typically calculated as your annual income multiplied by the number of years your family would need financial support. For example, if your family relies on your income for 15 years, multiply your annual salary by 15.M – Mortgage

Your mortgage is often your largest debt. Life insurance should ideally cover the remaining balance so your family can continue living in your home without financial strain.E – Education

Consider the cost of your children’s education, including college tuition, books, and other expenses. This ensures your children’s educational goals are not compromised.

Consequences of Not Having Life Insurance

Failing to secure adequate life insurance can have severe consequences:

Financial Strain on Family

Without insurance, your loved ones may struggle to pay bills, maintain their lifestyle, or cover outstanding debts.Loss of Home

Without funds to cover a mortgage, your family may be forced to sell their home during an already difficult time.Education Disruption

Your children’s education could be compromised, leaving them with student debt or missed opportunities.Increased Stress During Grief

Losing a loved one is emotionally challenging. Financial instability can add immense stress during this period.No Legacy or Inheritance

Life insurance can also provide funds to leave a legacy or support charitable causes. Without it, this opportunity is lost.

Key Life Insurance Statistics

52% of Americans do not have life insurance (LIMRA)

40% of insured individuals are underinsured

Average life insurance coverage per family: $168,000

Recommended coverage using DIME Method: 10–15 times annual income

These numbers highlight why evaluating your coverage using a structured method like DIME is critical.

Final Thoughts

The DIME Method offers a practical and easy-to-understand framework to ensure your family is financially protected. Life insurance is not just a policy—it’s peace of mind, security, and a way to leave a lasting impact on the people who matter most.

If you’re unsure how much coverage you need, consider consulting a licensed insurance professional who can customize a plan for your unique situation. Remember, planning today protects your family tomorrow.